This podcast is about brand storytelling. We’ll explore the crucial connection between REALTORS® and the emotional aspects of home buying and how to use those key elements to add value to your client relationships and the sales process.

Category: CREA News

Bank of Canada announces emergency interest rate cut

In an emergency announcement on March 13th, 2020 the Bank of Canada announced a 0.5% reduction in its trend-setting overnight lending rate from 1.25% to 0.75%. This was a further reduction from the 0.5% cut announced just 9 days earlier at the regularly scheduled interest rate announcement. The announcement was part of coordinated action by…

Canadian home sales up in February

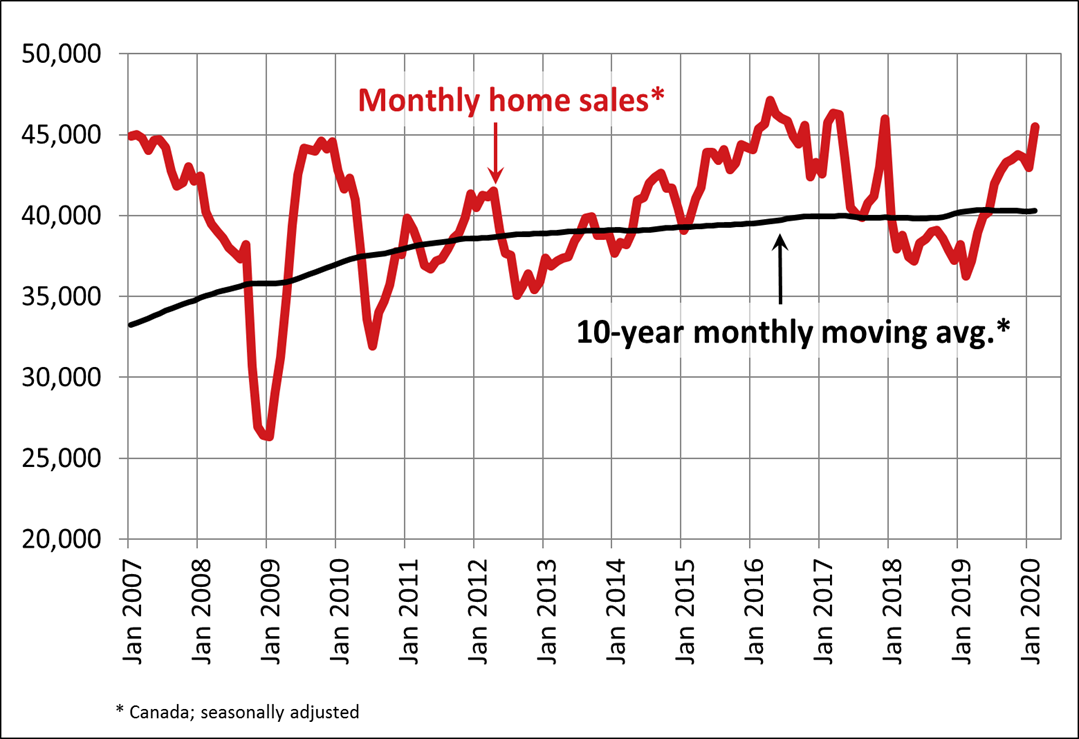

As providers of the most accurate and timely housing data and statistics, CREA cannot credibly update its quarterly forecast at this time. Ottawa, ON, March 16, 2020 – Statistics released today by the Canadian Real Estate Association (CREA) show national home sales were up between January and February 2020. Highlights: National home sales climbed 5.9%…

Bank of Canada cuts interest rates in response to rising global economic risks

In line with financial market expectations, the Bank of Canada announced, on March 4, it was lowering its trend-setting overnight lending rate by 50 basis points from 1.75% to 1.25%. This was the first change in the overnight lending rate since October 2018. This follows a day after the U.S. Federal Reserve cut the Federal…

Changes to the mortgage stress test

Ottawa, ON, February 18, 2020 – Earlier today, Minister of Finance Bill Morneau announced changes to the mortgage stress test. The new benchmark rate used to determine the minimum qualifying rate for insured mortgages, coming into effect on April 6, 2020, will be the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications,…